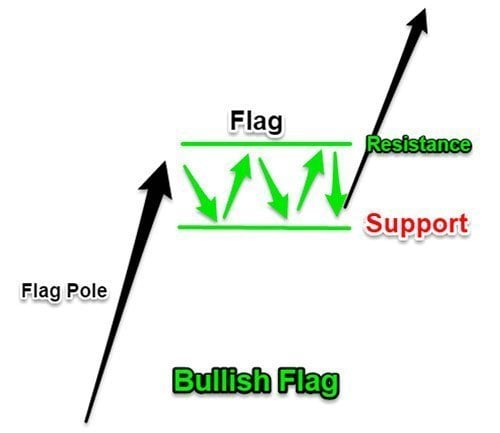

Flag: The area of consolidation in price action that follows and counters a preceding a sharp price movement.Bull Flag and Bear Flag Pattern TraitsĮvery bull flag and bear flag pattern is characterized by six primary traits: Let’s have a closer look at the bull and bear flag patterns. Depending on the trend right before the formation of a shape, flags can be both bullish and bearish. Flag patterns are used to forecast the continuation of the short-term trend from a point in which the price has consolidated. These patterns form when the price of a stock or asset moves counter in the short-term from the predominant long-term trend. What Are the Key Differences Between Bull Flag and Bear Flag Patterns?įlags are continuation patterns that allow traders and investors to perform technical analysison an underlying stock/asset to make sound financial decisions.

#Bull flag vs rising wedge how to#

How To Use Flag Patterns With The RSI Indicator?.Combining Bull and Bear Flags With Other Indicators.What does a Bear Flag Pattern look like?.What does a Bull Flag Pattern look like?.The move was so strong that the bulls never let the correction take on the shape of a normal consolidation pattern that forms pointing down in to the uptrend or a sideways type pattern such as a triangle or rectangle. Note the three red bullish rising patterns that made up that impulse leg to the double top at 775 area. Note the inverse H&S bottom that formed at the end of 2011 at roughly 450 or so. PCLN is a perfect example of what I've described above. Let’s look at a few charts that shows a very bullish move up that is made of several bullish rising wedges or flags. They are also like any other consolidation pattern that generally shows up as a halfway pattern.

#Bull flag vs rising wedge series#

The opposite is true in a downtrend where you can have a series of bearish falling wedges or flags form. When a stock is in a strong move up you can see series of these patterns that from one after another until a top is reached. I have found out through many years of following these bullish or bearish wedges or flags that they tend to show up in fast moving markets. A typical consolidation pattern, like a bullish falling wedge or flag, points down in an uptrend which everybody sees and is accepted as the norm. Instead of pointing down into the uptrend these type of patterns point up into the uptrend. I've been following these two types of patterns for many years and find that are just as reliable as any another consolidation or reversal pattern.Ī bullish rising wedge or flag forms in an uptrend. That means anything is possible regardless of what is taught by the so called experts. Keeping an open mind in the stock markets is the first lesson to learn. These type patterns are missed by 95% of chartists because they supposedly don't exist and if they do exist they can't be trusted. I'm repeatedly told to go back to charting school to learn my lesson. I have gotten more negative e mails from folks that assure me there is no such thing as a bullish rising wedge or flag. In today's Chartology Report I would like to clear up a misconception about rising wedges and flags.

0 kommentar(er)

0 kommentar(er)